US president-elect Donald Trump has pledged to fix the country’s infrastructure. Here are the banks with the best expertise.

Improving the US’s crumbling infrastructure was a key policy in the 2016 US presidential race. Comments by the victor Donal Trump suggest he is willing to roll out a $500bn programme over five years.

Banks’ project financing capabilities have been curtailed by Basel III capital rules that penalise holding long-term loans on balance sheet. However not all lenders have retreated from the business.

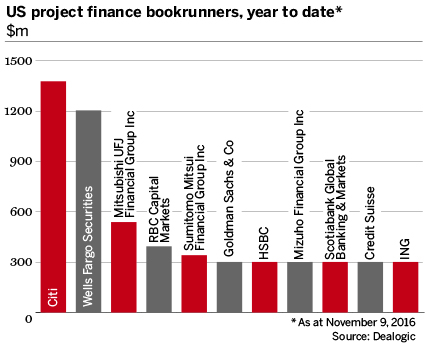

Dealogic data reveals that two local banks have played a big role in financing US projects this year: Citi has acted as bookrunner on $1.378bn of funding (across three deals) and Wells Fargo’s investment banking division has handled $1.205bn, which relates to a single project.

In terms of deal numbers, Japanese and Canadian banks are leading the way. Mitsubishi UFJ Financial Group, which ranked third in volumes, has worked on seven projects, followed by RBC Capital Markets and Sumitomo Mitsui Financial Group with five each.

The six banks comprising the chaser pack include a few European names.

Some notable absences are Société Générale Corporate & Investment Banking, JPMorgan and Crédit Agricole Corporate & Investment Bank, all of which placed in the top four last year.

All data sourced from Dealogic.