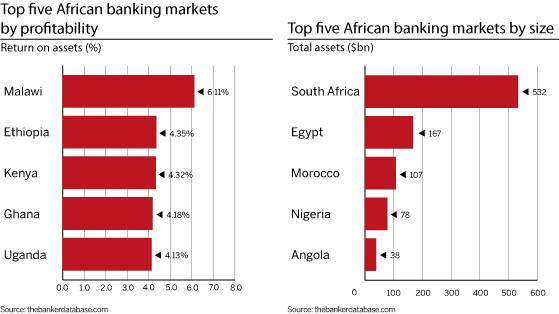

Four of Africa’s top five most profitable banking markets are in east Africa, with oil producing Ghana from west Africa completing the set.

Four of Africa’s top five most profitable banking markets are in east Africa, with oil producing Ghana from west Africa completing the set. Malawi stands out with a 6.1% return on assets in 2010, almost two percentage points ahead of second-placed Ethiopia on 4.4%.

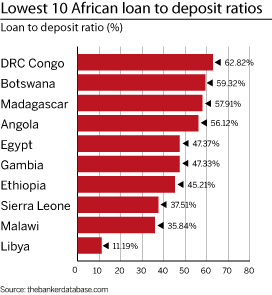

These are both smaller banking markets with relatively low banking penetration – loan-to-deposit ratios are well below 50%, suggesting very limited lending activity. And both countries have fewer than 10 banks with capital over $2m.

But larger markets are not necessarily less profitable. Kenya, with 21 banks that have almost $19bn in assets between them and a more mature loan-to-deposit ratio of 71%, is third in the ranking (excluding countries for which we have data from only one bank). The aggregate return on assets for Kenya is 4.3%, compared to an aggregate return on assets of just 0.69% for the 1000 largest banks worldwide.

That said, profitability in most of Africa’s largest five markets is comparatively low, with return on assets at 2.1% in Nigeria and below 2% in Morocco, Egypt and South Africa. Angola, another country expanding its oil production, is the exception, with return on assets at 3.33% making it the 10th most profitable banking sector. A loan to deposit ratio of just 56% - compared to 101% in South Africa – clearly indicates that Angola is still a relatively underdeveloped banking market.