As the Spanish banks are seeking to expand with acquisitions abroad, bolstered by recovery at home, The Banker assesses the local top five banks by Tier 1 capital.

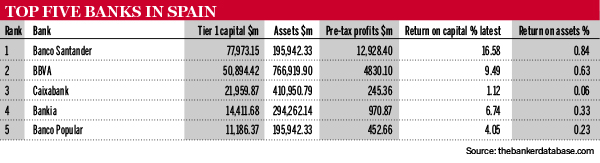

With the Spanish economy picking up and its banks emerging from a slump, The Banker has ranked the country’s banks by Tier 1 capital. According to the ranking, Santander, which is also a prominent player on the global scene, holds the largest amount of capital by a large margin – nearly $78bn – and, with pre-tax profits of $12.93, it is also the most profitable Spanish bank. The lender also has the highest return on capital, 16.58%, and highest return on assets, at 0.84%.

It is followed by BBVA, another Spanish lender with a global presence, which is also second in terms of profitability and returns on capital and assets.

The third largest bank in Spain is Caixabank, which unlike the other two is a traditional savings bank with a purely domestic focus. The fourth and fifth spots are occupied by Bankia and Banco Popolar, which hold $14.41bn and $11.19bn in core capital, respectively.

The table was produced using The Banker Database, which provides comprehensive financial data, news feed and executive contact data for more than 5000 of the world's leading banks. For more in-depth information on the UK's banking system, and that of more than 190 other countries, visit www.thebankerdatabase.com.