Tigers show how to weather market storms

Our rankings reveal no evidence of a bursting Asian bubble as China, and India to a lesser extent, power onwards.

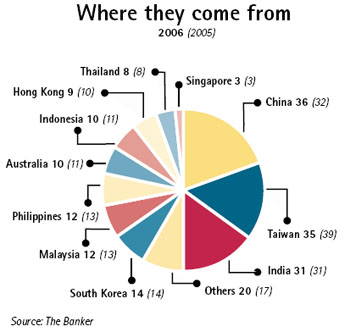

Buoyant global economics in 2006 were reflected in the Asian economies and the performance of the Top 200 Asian banks in our latest listing. With the two “Tiger” economies, China and India, continuing to forge ahead, the region saw increased growth in both corporate and personal lending.

Fears of the “bubble” bursting seem premature as the Asian economies seemed to weather the recent market turbulence better than their western counterparts.

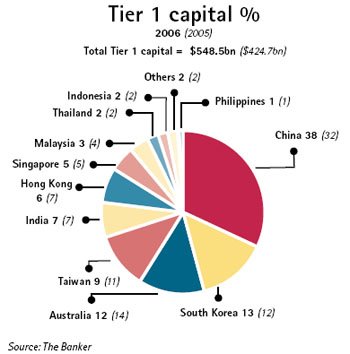

The Banker’s Top 200 posted a 29.1% increase in Tier 1 capital to $548.5bn, while aggregate assets grew 20.1% to $9940.4bn and aggregate pre-tax profits rose 24.9% to $110.3bn.

Looking at the major countries in our listing, China again dominates with its largest banks filling the top three places. ICBC (Industrial & Commercial Bank of China) resumes its place at the head of the list with the completion of its initial public offerings (IPOs) in the last quarter of the year, followed by Bank of China and China Construction Bank.

ICBC saw a rise in Tier 1 capital of 80.8% to $59.2bn and Bank of China 62.1% to 52.5bn while China Construction saw a more modest rise of 16.2% to $42.3bn, having seen its major increase the previous year.

These three are joined in the Top 200 by a further 33 banks from China, further evidence of the strong development of the banking sector not only in the big cities on the eastern seaboard but also in the rural hinterland.

The Chinese banks account for 38% of the aggregate Tier 1 capital, 40% of aggregate assets and 33% of aggregate pre-tax profit. Guangdong Development Bank and China Everbright Bank were excluded from the list having failed to produce financial figures for the last three years. Having been finally acquired by the Citigroup-led consortium earlier this year, it is hoped Guangdong Development Bank may reappear soon in these listings. China Everbright is also undergoing restructuring.

Hong Kong’s representation dropped to nine from 10 last year, but still managed to produce 8% of the Top 200 aggregate pre-tax profits from 6% of the aggregate assets while Australia’s representation also fell from 11 to 10 but they still managed to produce 20% of aggregate pre-tax profits from 14% of the aggregate assets and 12% of aggregate Tier 1 capital.

Indian failings

India, the other “Tiger” economy, remains the enigma with its 31 banks only producing 7% of aggregate profit from 7% of assets and 7% of Tier 1 capital. The sector is still failing to take advantage of the country’s economic boom.

Taiwan’s profits recovered slightly showing a 5% increase to $2.240bn from a smaller representation of 35 banks/holding companies although this may only be the effects of bank consolidation or increased holding company reporting for bank groups. It still only managed to produce 2% of aggregate pre-tax profit from 8% of assets and 9% of Tier I capital.