Top 300 Asia-Pacific Banks ranking: China dominates, India and Indonesia show growth

China’s lenders have the largest slice of the Top 300 Asia-Pacific Banks ranking, while privately owned Indian banks and south-east Asian lenders show impressive Tier 1 capital growth and profitability. Stefania Palma reports.

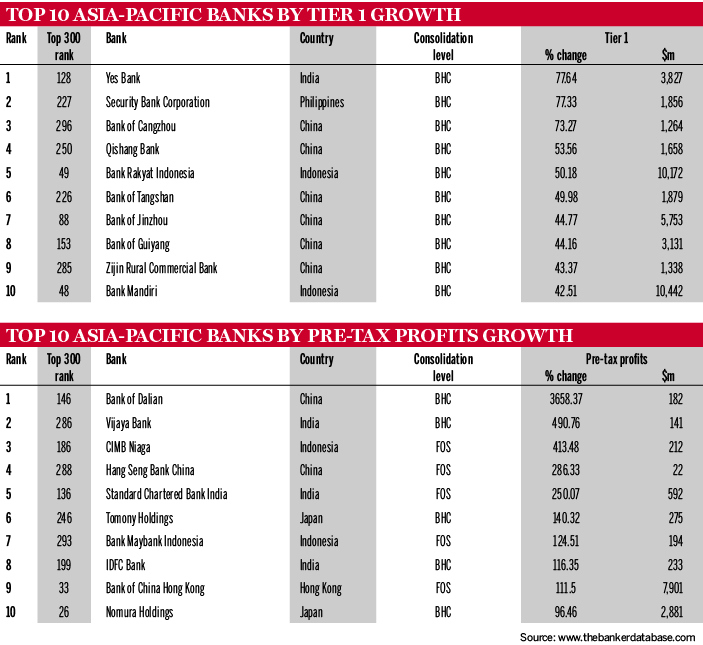

The performance of China's lenders in The Banker’s Top 300 Asia-Pacific Banks ranking by Tier 1 capital is a clear testament to their incredible rise. One-third of the lenders in the Top 300 and four out of the five top banks are Chinese. But while the country’s dominance of the Top 300 is stark, Chinese lenders in the ranking registered an aggregate drop in pre-tax profits of 5.48%.

The second largest jurisdiction to be represented in the Top 300 is Japan, with 58 banks. The highest ranking lender from the country – Mitsubishi UFJ Financial Group – is in fifth place. Japan’s other two mega-banks, Sumitomo Mitsui Financial Group and Mizuho Financial Group, come in at seventh and eighth place, respectively. Among Japan’s lenders in the Top 300, Tokyo TY Financial Group registered the biggest jump in Tier 1 capital (41.85%), pushing the lender up 47 spots to 179th.

While China’s banks prevail in the Top 300, Indian banks dominate other key performance tables. Privately owned lender Yes Bank registered the highest growth in Tier 1 capital in Asia-Pacific – a 77.64% year-on-year rise to $3.83bn in 2017 – that pushed it up 69 places to 128th in the Top 300. IDFC, the top bank in Asia-Pacific by asset growth, is also Indian.

Indonesian growth

South-east Asian lenders have also performed well. The nine Indonesian banks in the Top 300 stand out for registering the highest aggregate growth in Tier 1 capital, at 32.99%. The highest ranking lender in the listings is Indonesia's Bank Mandiri, in 48th place.

Meanwhile, Vietnam registers the smallest aggregate growth in Tier 1 capital, at 2.8%. However, the country has only four banks in the listings and they registered the second largest aggregate growth in pre-tax profits, at 11.66%.

At the other end of the spectrum, the 12 South Korean banks in the Top 300 posted the biggest aggregate drop in pre-tax profits (14.94%). The 10 Australian banks in the ranking had a similar squeeze in pre-tax profits of 14.81%.

Pakistan and Macau have the smallest number of lenders in the listings, with one bank each. However, Pakistan’s Habib Bank registered the highest return on capital in the Asia-Pacific region, at 38.85%.