With strong capital levels and minimal NPLs, local lenders can support Argentina’s economic revival, reports Danielle Myles.

For Argentina, 2016 is proving a pivotal year. Following the election of new president Mauricio Macri last December, the government ended a 14-year legal battle with holdout creditors over its 2001 default, and made its landmark return to international capital markets with a heavily oversubscribed $16.5bn bond.

After years of stunted growth under former leader Cristina Fernández de Kirchner, many hope that the Latin American country is on the cusp of economic recovery. Data collected by The Banker suggests its banks could help support that turnaround.

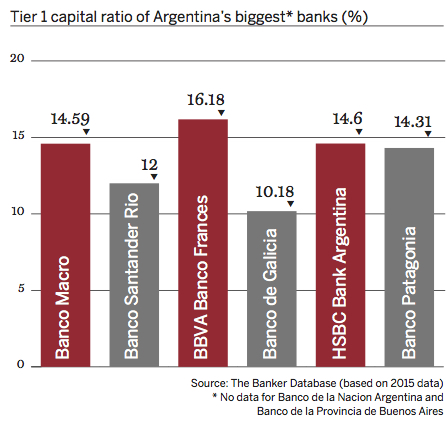

Basel III has been implemented locally and banks are healthily capitalised. Among the top tier lenders, Banco Macro’s Tier 1 ratio is 14.59%, Banco Santander Rio’s is 12% and BBVA Banco Frances’s is 16.18%. What is more, their non-performing loan (NPL) levels are remarkably low. NPLs account for 1.51% of Banco Macro’s loan book, while at Banco Santander Rio the figure is 0.88% and at BBVA Banco Frances it is 0.57%.

As demand for loans increases, banks may have to increase their Tier 2 capital buffers. Banco Galicia, the country’s fifth biggest lender, has demonstrated that foreign investors are keen for this exposure. In July it became the first bank to tap the international bond markets since Mr Macri took office, selling $250m of Tier 2 subordinated debt.