Foreign exchange swings have masked regional lenders’ success in shrinking their balance sheets.

Many of Europe’s big banks have spent the past few years trying to downsize. They have done this by creating and then closing non-core units, exiting business lines and selling underperforming asset portfolios to become simpler, leaner and more focused on their strengths.

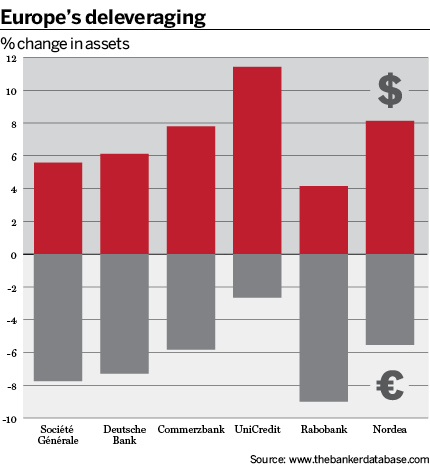

The Banker’s Top 1000 World Banks methodology, which converts figures to US dollars to create a comparable ranking, belies the success of their efforts in 2017. This is because the euro, in which they report, gained 12.6% against the dollar to become the year’s best performing currency. The rankings suggest European bank assets grew 11.4%, but a euro-denominated analysis of a sample of the region’s biggest lenders paints a different picture.

The best example is Deutsche Bank, which is in the throes of scaling back its troubled investment banking operations. In dollar terms it appears that Deutsche added 6.1% in assets during 2017, when in reality they diminished 7.3%. Compatriot Commerzbank shrunk nearly 6% in pursuit of its goal to run down non-strategic assets. Further north, Nordea rationalised its balance sheet by 5.5% while Rabobank cut nearly 10% of its assets. What looks like a double-digit expansion at UniCredit is actually a 2.7% drop, while Société Générale is nearly 8% smaller than in the 2017 rankings.