Nordea, the largest bank in Sweden, is intent on increasing its international footprint. Data collected by The Banker suggests it is ready to broaden its horizons. Danielle Myles reports.

Sweden’s biggest bank, Nordea, has set its sights firmly on overseas territories. Last year, it was in takeover talks with the Netherlands’ ABN Amro, until the Dutch government made clear it was unwilling to sell its controlling stake.

In April this year, Nordea received US regulatory approval to open a branch in New York. In the same month, it suggested it might move its headquarters out of Sweden if the government follows through with proposals to increase the bank’s contributions into the national resolution fund.

Any market should feel graced by Nordea’s presence. At more than twice the size of Sweden’s second biggest lender, SEB, measured by both assets and Tier 1 capital, Nordea is the jewel in Sweden’s banking industry.

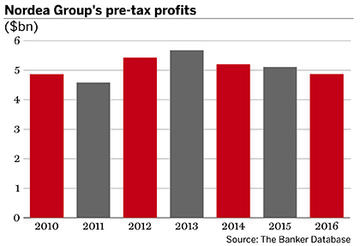

It has a capital adequacy ratio of 24.7% and a non-performing loan ratio of just 1.63%. It is also one of the few consistently profitable large banks in Europe. Despite Sweden’s record-low interest rates, over the past seven years, Nordea has recorded between $4.589bn and $5.677bn in pre-tax profits.

This translates to a return on equity (RoE) of between 13.58% and 15.16%. The only to rival that is Dutch lender ING, which recorded a 13.45% RoE in 2016.

All data sourced from www.thebanker.com