Poor lending policies and over-exposure to a faltering real estate sector have seen Tanzania's banks experience an uncomfortable past few years. However, as Jason Mitchell reports, they have cut costs, lowered NPLs and embraced technology to impressive effect.

Tanzania’s commercial banking sector has started to stabilise after many of its banks had to set aside vast sums of money, in 2016 and 2017, for impairment losses on bad loans. Some of the country’s largest lenders – including CRDB Bank, NMB Bank, Standard Chartered and Barclays Bank Tanzania – were left reeling after loans they made to the real estate sector between 2010 and 2015 started to sour, as plunging commodity prices contributed to a wider downturn in the economy.

This overexposure to the real estate sector led to a jump in the industry-wide non-performing loan (NPL) ratio, which peaked at 11.5% in 2017, up from 6.8% in 2014, according to the International Monetary Fund (IMF). At the end of 2017, 24 banks still had ratios exceeding 10%. However, by the end of 2018, the industry witnessed some improvement, with the overall ratio declining to 10.4%, according to Bank of Tanzania, the country’s central bank.

Bank write-offs

Among the worst performing banks with regards to NPLs were Efatha Bank – linked to Efatha Ministry, a Tanzanian church – and Ecobank Tanzania. The former saw its NPL ratio peak at 63% at the start of 2017, while the latter’s reached 57%. Standard Chartered had to write off TSh18bn ($7.77m) of bad loans to bring its NPL ratio down from 9.1% at the start of 2017 to 0.3% today. The impairment brought its net profit down from TSh39.5bn in 2017 to TSh19.8bn in 2018.

Similarly, Barclays – whose NPL ratio in Tanzania now stands at 3.3%, down from a peak of 19% in mid-2016 – saw its net profit nosedive to TSh8.4bn in 2018 from TSh13.3bn in 2017 (Barclays Bank Tanzania will rebrand to Absa in the first half of 2020). Stanbic Bank – Standard Bank’s Tanzania subsidiary – saw its net profit fall slightly to TSh17bn in 2018 from TSh19bn in 2017. The bank’s NPL ratio peaked at 19% at the end of 2016 but is now about 3%.

“In common with other major banks in Tanzania, our bank has had a significant challenge relating to non-performing commercial loans,” says Abdi Mohamed, managing director at Barclays in Tanzania. “It arose from a combination of banks’ lending policies and aspects of the economic and business cycle a few years ago. However, the bank has now managed to turn around the NPL ratio significantly.

“We achieved it partly by collections and recoveries through the legal process; however, the bank’s asset book has also been growing, leading to a lower NPL ratio. Ensuring we maintain an NPL level below the regulatory threshold remains a key objective and we will continue to work with all stakeholders on this key agenda.”

Central bank measures

In response to the bad loans crisis, in June 2017 Bank of Tanzania raised the minimum core and total capital ratios to 10% and 12%, respectively. It also required banks and financial institutions in Tanzania to hold an additional capital conservation buffer of 2.5% of risk-weighted assets and off-balance-sheet exposures. It made all banks with an NPL ratio above 5% submit a regularisation plan with clear timelines.

In January 2018, the central bank revoked the banking licences of Efatha Bank and four other community banks: Covenant Bank, Njombe Community Bank, Kagera Farmers’ Cooperative Bank and Meru Community Bank. It had given these institutions a five-year implementation period to raise their minimum capital to TSh2bn by December 31, 2017 – from a TSh250m minimum – but they had not managed to do so by the deadline.

In the middle of 2018, Bank of Tanzania also forced TPB Bank to merge with two underperforming financial institutions, Twiga Bancorp and Tanzania Women’s Bank. Consequently, its NPL ratio climbed to 12.87% in September before dropping to 6.9% by the end of 2018. Its net profits rose to TSh14.5bn last year from TSh12.8bn in 2017.

The central bank also took over the management of another bank – called Bank M – in August 2018, citing critical liquidity problems. By June 30, 2018, its total loans had surpassed its deposits by 32.7%. In January 2019, Bank of Tanzania transferred Bank M’s assets and liabilities to Azania Bank, which now has total capital of TSh164bn, way above the minimum capital requirement of TSh15bn.

“Asset quality has been the main challenge for Tanzanian banks during the past few years,” says Christos Theofilou, a vice-president and senior analyst at Moody’s, which assigns the country’s biggest two banks, CRDB and NMD, the same credit rating of B1 with a 'negative' outlook.

“The banks have had a challenging operating environment during the past few years. The real economy has slowed down and this has impacted banks. In 2016, the government began to introduce austerity measures and reduced its spending. It attempted to tackle tax evasion and raised the corporate tax rate but this had the adverse effect of reducing companies’ capacity to service their bank loans. Although the overall business climate remains subdued, the banking environment has stabilised, reducing asset quality risks for banks,” says Mr Theofilou.

Real estate slump

Bankers cite the closure of some businesses, the decline in trading activities, high operational costs and enhanced government expenditure control measures as contributary factors to the rise of NPLs. In tandem, a collapsing real estate market has played an outsized role in the growth of NPLs in the system.

“Five years ago, the real estate sector gave investors very good returns but during the past couple of years they have dropped to zero,” says Moremi Marwa, chief executive officer at the Dar es Salaam Stock Exchange – which in January became one of the few African stock exchanges to become a full member of the World Federation of Exchanges.

“The banking industry became very exposed to this one sector and an over-supply of property came on the market. When the economy started to decline in 2016, property prices slumped by up to 30%, prompting the banks’ NPL rates to climb. Most big real estate developments have been put on hold now,” he adds.

David Mestres Ridge, chief executive officer of Swala Oil & Gas, a Tanzanian oil and gas exploration company, says: “A few years ago, banks and investors piled into the real estate sector but things went badly wrong. Banks were exposed to several specific property developers and some big loans were defaulted on. It’s the reason we see a lot of half-empty buildings in Dar es Salaam today.”

IMF warning

At the end of 2018, the IMF warned that almost half of Tanzania’s banks were still vulnerable to adverse shocks and ran the risk of insolvency in the event of a global financial crisis, despite all the measures taken by the central bank. Potential shocks included a slowdown in domestic growth, a currency depreciation and a spike in domestic inflation. The IMF urged the country to improve asset quality further, address the NPL issue more thoroughly, and increase capital buffers in the banking system.

“Solvency stress tests reveal that 22 banks – representing 32% of banking assets – would become undercapitalised in the tail-risk scenario,” the IMF said in its latest financial system stability assessment. The stress tests revealed that six banks were undercapitalised at the time, while a further 37 showed under-provisioning to various degrees. The IMF also advised the government to enhance surveillance and monitoring of liquidity risks in the foreign exchange market and undertake measures to mitigate them. It said bad loans continued to pose a risk to the country’s financial system.

Nevertheless, some of Tanzania’s biggest banks saw their profits rise in 2018 despite the crisis in the real estate sector. At CRDB Bank, net profits jumped by 127.8% to reach TSh70bn in 2018 from TSh31bn in 2017. At NMB, net profits rose to TSh106bn in 2018 from TSh93bn in 2017. KCB Tanzania, a subsidiary of KCB Bank of Kenya, saw its net profitability skyrocket by 5267% in 2018 to TSh11.37bn from TSh212m in 2017.

Banks have been shedding staff to bring down costs. CRDB reduced its head count to 2882 in June 2018 from 2912 in the same month the previous year, despite opening five new branches. Ecobank reduced one branch from its portfolio and cut employee numbers from 185 to 128 during the same period. Commercial Bank of Africa (CBA) closed down five branches and laid off 21 employees.

Growth opportunities

This combination of cost cutting and stronger profitability bodes well for Tanzania’s lenders as they look to the future. Indeed, long-term growth opportunities in the domestic market remain abundant, even as the challenges of the past continue to loom large. One government priority is to improve financial inclusion. According to the 2017 Finscope Tanzania report, the proportion of the adult population that has a bank account was 16.7% in 2017, compared with 14% in 2013 and only 9% in 2009. However, the share of the adult population in the country that is formally financially included jumped to 65% in 2017 from 16% in 2009, according to the central bank.

“The dramatic increase of the financially included population percentage has been primarily driven by the spread of mobile money services,” says professor Florens Luoga, Tanzania's central bank governor. “Mobile money is largely used for person-to-person transfers, but the platform has not yet been exhaustively utilised to upgrade consumers from transactional services to full financial services, in particular, saving and credit services.”

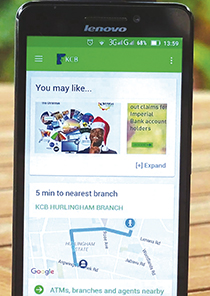

In common with all of Tanzania’s main commercial banks, KCB is rolling out a new digital platform for its customers, including a mobile money app called Vooma. The bank believes the app – which enables clients to send money, make payments and track and manage their expenses – will help it expand its client base from 15,000 people to between 22,000 and 23,000 by the end of 2019.

Pascal Machango, head of treasury at KCB Bank – which has TSh600bn in assets, 10 branches and 11 ATMs – says: “Our bank plans to expand through improving its digital offering. We will not open additional physical branches. The government is pushing financial inclusion and mobile banking as the best way to achieve it. In the long term, Vooma will result in many more clients in all corners of the country.”

Standard Chartered – which has five branches in Tanzania, 17 ATMs and about 300 staff – is also introducing a new digital platform, Straight to Bank, which is mainly targeting business clients. It enables customers to view balances and transactions over the internet and manage reports for their business. It also provides reconciliation capabilities customised to their specific needs.

Sanjay Rughani, chief executive officer at Standard Chartered in Tanzania, says: “Our strategy is to become the best performing international bank in Tanzania. We want to be the leading corporate bank and would like to help Tanzanian firms to expand internationally.

“Furthermore, I believe we will be able to improve financial inclusion through our enhanced digital platform. At the end of 2018, it was estimated that up to 22 million people had registered for national identity cards. Eventually, this will enable many more people to enter the banking system.”

Tanzania’s banking system has suffered all kinds of problems over the past few years, largely because its banks had adopted lax lending policies and had become over-exposed to the real estate sector. They have now gone through a period of retrenchment and managed to stabilise their profitability. With 25 million Tanzanians aged over 18, ensuring they all have access to financial services offers banks plenty of opportunity in future.