If there is one positive to be found as banks, and economies across the board, enter a period of unprecedented turbulence, it is that years of post-global financial crisis reform have delivered a banking system that is safer, better capitalised and should be more resilient in the face of economic disruption. In the current circumstances, the regulatory requirements introduced in the wake of the 2007-08 crisis – which at times seemed onerous – may prove their worth.

Top 1000 aggregates

| 2020 ($bn) | 2019 ($bn) | change from preious year (%, bps) | |

| Aggregate Tier 1 | 8,796 | 8,292 | 6.08 |

| Aggregate Total Assets | 128,113 | 122,801 | 4.33 |

| Aggregate Pre-Tax Profits | 1,159 | 1,135 | 2.13 |

| Profits/Tier 1 (%) | 10.52 | 10.87 | -35.44 |

| Return on Assets (%) | 0.72 | 0.73 | -0.80 |

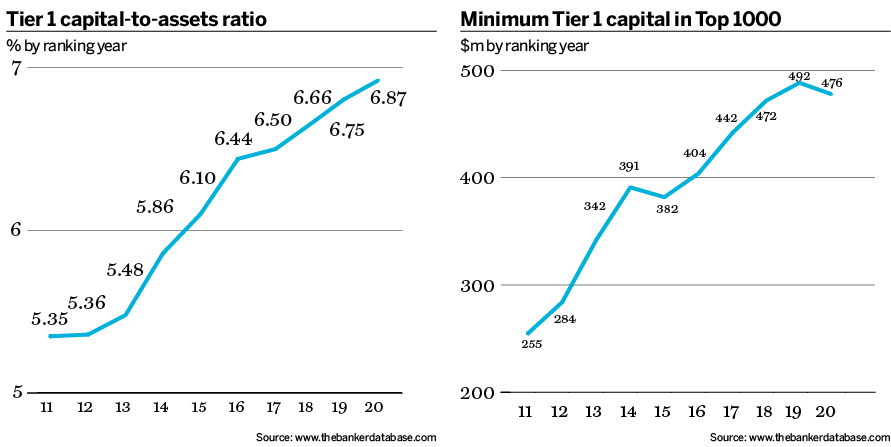

The aggregate level of Tier 1 capital held by the world’s 1000 largest banks stood at $8796bn at the end of 2019 (the review year that the Top 1000 World Banks ranking is based on), the highest it has ever been. This marks a 6.08% year-on-year increase from the 2019 rankings, and an 79.64% increase from the aggregate total in 2010. The aggregate Tier 1 capital-to-assets ratio for the Top 1000 also reached its highest ever level at 6.87% – this ratio has steadily increased over the past 10 years from 5.14% in 2010.

Although the minimum level of Tier 1 capital held by a bank in the Top 1000 ranking has taken a slight dip, standing at $476m, compared to $492m in last year’s rankings, it is still at its second highest-ever level. Had it not been for the fact that 24 Indian banks and 10 Lebanese banks were unable to provide data for our analysis this year and therefore couldn’t be included in the rankings, we would have likely seen this figure increase.

Overall, the data at a global level points a banking system that ended 2019 in generally good health. At an aggregate level, total assets for banks in the Top 1000 stood at $128,113bn, a 4.33% increase from 2019. Aggregate pre-tax profits also increased year-on-year to $1,159bn, a 2.13% year-on-year increase.

Looking beyond capital levels and profits, there are many other factors that determine how well banks perform overall. From page 120 to 153 of this year’s Top 1000 report, The Banker examines in detail how well banks in 20 of the world’s leading economies performed in the past year, and in what shape they were in entering the coronavirus period, using additional data from The Banker Database. This is the first time we have included our best-performing banks analysis in our Top 1000 reporting, which examines performance based on 18 different indicators across eight key categories: growth, profitability, operational efficiency, asset quality, return on risk, liquidity, soundness and leverage.

Regions by total Tier 1 capital/assets/pre-tax profits ($bn)

| Tier 1 Capital | Assets | Pre-tax profits | |

| China | 2,482 | 31,573 | 330 |

| US | 1,464 | 17,363 | 253 |

| Eurozone | 1,399 | 26,071 | 129 |

| Japan | 691 | 14,023 | 41 |

| UK | 404 | 7,868 | 38 |

Chinese capital vs US efficiency

China has once again consolidated its leading position at the head of the Top 1000 table. ICBC, China Construction Bank, Agricultural Bank of China, and Bank of China hold the top four positions for the third year running, with ICBC in first position for the eighth consecutive year. All four saw substantive increases in Tier 1 capital of between 10% and 14%, as well as modest pre-tax profit increases of between 3% and 7%.

Out of the top 20 banks in the rankings, seven are Chinese, one more than last year, with Shanghai Pudong Development Bank moving up the Tier 1 capital ranks from 24th place to 20th. China has 143 banks in 2020’s Top 1000 World Banks ranking (seven more than 2019), a total beaten only by the US with 184 banks in the ranking (15 more).

Although we may now be passed the stage where pre-tax profit growth across China’s banks is in the double digits (last seen in 2014), they have bounced back from last year’s 3.04% dip, to grow by 5.72%.

As the country where Covid-19 originated, China was the first to bear its economic brunt – but it is also one of the first to see its economy return to more normal functioning. However, it is not yet out of danger. Domestically, localised outbreaks remain likely (at the time of writing, some cases had been identified in Beijing); and internationally, the virus is rampant, hitting both demand and supply chains for Chinese goods.

China’s banks are likely to take a hit in the next year, particularly as they are highly exposed to the fortunes of the country’s businesses, with 55.67% of outstanding gross loans going to corporate borrowers. China has $17,905.6bn worth of gross loans outstanding, spread across 143 banks. This is considerably higher than for any other country; the nearest comparison is the US with $8052.9bn of gross loans outstanding, spread across 184 banks, and 47.51% of that total lent to corporate borrowers.

Regional aggregate profitability

| region | ROA (%) | ROE (%) | ROC (%) |

| Africa | 1.57 | 16.09 | 19.49 |

| China | 0.87 | 10.73 | 11.02 |

| Japan | 0.22 | 4.37 | 4.53 |

| Asia Pacific (ex China and Japan) | 0.79 | 9.06 | 10.54 |

| Central and Eastern Europe | 1.79 | 14.30 | 15.04 |

| Europe | 0.38 | 5.91 | 6.90 |

| Middle East | 1.43 | 11.28 | 12.41 |

| North America | 1.11 | 11.29 | 14.40 |

| Latin America (total) | 1.60 | 17.08 | 20.84 |

The US’s biggest banks have also held their positions in the rankings. For the third consecutive year, JPMorgan Chase, Bank of America, Wells Fargo and Citigroup make up the fifth, sixth, seventh and eighth placed banks in the Top 1000, in what was a relatively unremarkable period for the US banks. Aggregate pre-tax profits remained largely static, with a 0.65% fall – despite an additional 15 US banks being included in the rankings this year.

Overall, however, US banks continue to be considerably more cost and capital efficient than their Chinese peers. Chinese banks hold 24.64% of total global assets and account for 28.46% of global pre-tax profits, compared to just 13.55% of assets for US institutions, yet 21.86% of profits. At an aggregate level, return on assets (ROA), a measure that shows profits earned against a bank’s resources, stands at 1.11% for North American banks (which includes Canada) and at 0.87% for Chinese banks.

China vs US loan book breakdown

| Country | Gross total loans ($m) | Financial institutions | Corporate | Government | Retail |

| China | 17,905,600 | 6.01 | 55.67 | 0.57 | 37.75 |

| US | 8,052,941 | 7.11 | 47.51 | 0.18 | 45.2 |

One clear example of a US bank outperforming its Chinese peers is JPMorgan Chase. It achieved pre-tax profits of $44.5bn, a 9.19% increase on the previous year and greater than the profits achieved by Bank of China and Agricultural Bank of China, both ahead of it in the Tier 1 capital rankings. It is relatively easy to pinpoint why: JPMorgan has a very respectable return on equity (ROE) of 13.93% (up from last year’s 12.66%) and an ROA of 1.36%, the highest of any bank in the top 20.

Its performance was not matched by its US peers, however. Bank of America’s pre-tax profits fell by 5.29%, and although Citigroup saw an increase, it was a small 1.85%. Wells Fargo, still recovering its reputation and bearing financial costs from the 2016 “fake accounts” scandal, saw its pre-tax profits decrease by 15.2%. The bank appointed a new CEO, Charlie Scharf, in October 2019, hoping to move the institution forward into a new, more profitable, chapter.

Ten biggest moves from loss to profit ($m)

| Bank Name | Pre-Tax Profits | Previous Pre-Tax Profits | Recovery |

| Nomura Holdings | 2,284 | -340 | 2,624 |

| Banco BPM | 951 | -314 | 1,264 |

| Suruga Bank | 293 | -677 | 970 |

| Piraeus Bank Group | 442 | -309 | 751 |

| Alpha Bank | 163 | -333 | 496 |

| Credit Europe Bank | 16 | -349 | 365 |

| Gulf International Bank | 66 | -220 | 286 |

| Credito Valtellinese | 34 | -114 | 148 |

| Banca Monte dei Paschi di Siena | 40 | -88 | 128 |

| Cassa di Risparmio di Asti | 68 | -17 | 85 |

Western European woes

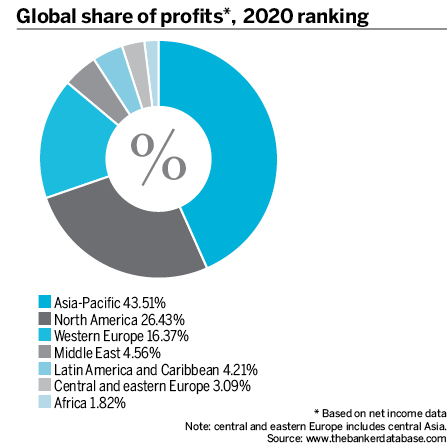

It was another difficult year for western Europe’s banks, which have struggled to perform in an environment of relatively weak economic growth and negative interest rates. Although they still held the third largest share of global profits, after Asia-Pacific and North America, western European banks’ portion has fallen from to 16.37%, from 18.59% last year.

It was a particularly difficult year for Europe’s largest bank, HSBC; its pre-tax profits dropped by a third year-on-year. It cited a $7.3bn “goodwill impairment” as the cause of the loss. This impairment reflected “lower long-term economic growth rate assumptions” in its global banking and markets and its European commercial banking businesses, as well as costs associated with the “planned reshaping” of its global banking and markets business.

In a bid to arrest the decline, in February 2020, the bank announced a major restructuring programme that will reduce its European and US operations, and refocus resources towards the Middle East and Asia, reportedly with the loss of 35,000 jobs. In March, it announced a pause in redundancies due to the coronavirus outbreak but the plans are said to be back under way.

Latin America pre-tax profits share evolution (%)

| 2010 | 2019 | 2020 | |

| Brazil | 82.75 | 57.19 | 54.88 |

| Chile | 3.78 | 6.72 | 7.03 |

| Colombia | 3.15 | 7.97 | 8.54 |

| Mexico | 3.06 | 9.03 | 10.45 |

HSBC, which has been headquartered in the UK since 1993 but makes most of its profits in Asia, faces a challenging year ahead on several fronts. At the end of March, it announced it would cancel its 2019 dividend payments (in line with other UK-based banks), following pressure from the UK’s Prudential Regulation Authority to suspend the payments during the pandemic and its ensuing economic disruption. The move is said to have angered many Hong Kong-based investors, who own a large proportion of HSBC shares.

The bank has also faced criticism from UK and US politicians following a post on Chinese social media platform, WeChat, that apparently endorsed China’s new security law for Hong Kong, which Beijing wants to introduce in the wake of protests in the special administrative region during 2019. As the bank seeks to pivot more towards Asia, it is likely to face a difficult geopolitical balancing act.

Middle East pre-tax profits share evolution (%)

| Country | 2000 | 2005 | 2010 | 2015 | 2020 |

| Israel | 22.56 | 13.37 | 9.09 | 7.29 | 9.89 |

| Qatar | 2.33 | 3.7 | 12.53 | 15.09 | 15.05 |

| Saudi Arabia | 27.55 | 33.43 | 26.7 | 24.3 | 28.9 |

| United Arab Emirates | 10.86 | 12.69 | 20.45 | 26.08 | 27.25 |

At an aggregate level, pre-tax profits across UK banks fell 12.73% year-on-year. Lloyds Banking Group and Nationwide Building Society were two other large banks to see big year-on-year dips in profits of 23.38% and 20.35%, respectively. Barclays, the UK’s second largest bank, fared better with a 29.62% increase in pre-tax profits, although its position in the Tier 1 capital rankings fell to 28th position, from 25th the previous year. With UK banks facing the double challenge of the coronavirus pandemic and likely disruption following the end of the Brexit transition period on December 31, as the UK withdraws from the EU in substance as well as name, the year ahead is likely to be tricky.

French banks took the largest share of European banking profits for the fifth consecutive year, although their pre-tax profits slumped slightly, by 1.96%. France’s second, third and fourth largest banks – BNP Paribas, Groupe BPCE and Crédit Mutuel – returned modest increases in pre-tax profits of 9.11%, 2.2% and 2% respectively. However, the country's largest bank, Crédit Agricole, saw a year-on-year drop in pre-tax profits of 8.65% and at Société Générale pre-tax profits were down 16.74% year-on-year – although performance, particularly in its investment banking division, had picked up in the final quarter of the year.

Top 15 countries with lowest aggregate return on assets

| Country | Region | RoA |

| Germany | Western Europe | 0.01 |

| Greece | Western Europe | 0.10 |

| Cyprus | Western Europe | 0.12 |

| Portugal | Western Europe | 0.13 |

| Japan | Asia-Pacific | 0.22 |

| Luxembourg | Western Europe | 0.29 |

| France | Western Europe | 0.31 |

| Finland | Western Europe | 0.32 |

| Ireland | Western Europe | 0.34 |

| UK | Western Europe | 0.35 |

| Belgium | Western Europe | 0.37 |

| Estonia | Central and Eastern Europe | 0.39 |

| Italy | Western Europe | 0.43 |

| Denmark | Western Europe | 0.44 |

| Netherlands | Western Europe | 0.45 |

ROA across western Europe was already at a pretty dire 0.43% last year, and it has now fallen to 0.38%. Similarly, ROE has also fallen from 6.71% last year to 5.91% this year. Of the 15 countries with the lowest ROAs, globally, 13 of them are in western Europe.

The situation is particularly extreme in Germany, where average ROA now stands at a negligible 0.01%, down from 0.09% last year. Germany’s embattled Deutsche Bank experienced another tough year, coming in second in the biggest loss table. Only India’s troubled Yes Bank has a bigger loss than Deutsche’s loss of $2.96bn. Germany’s largest bank is currently undergoing a large scale restructuring programme, including cutting its global headcount by 18,000, and has cited costs associated with this as the reason for making a loss in 2019. The bank paused redundancies in March as the coronavirus pandemic took hold in Europe, but the process is reportedly back under way. Its position in the Tier 1 capital rankings has also dropped a further five places, from 27th place to 32nd.

Number of banks in the Top 1000 by region

| World Region | 2019 | 2020 | Change |

| Africa | 33 | 36 | 3 |

| Asia-Pacific | 387 | 372 | -15 |

| Caribbean | 7 | 7 | 0 |

| Central America | 16 | 18 | 2 |

| Central and Eastern Europe | 39 | 44 | 5 |

| Central Asia | 2 | 4 | 2 |

| Middle East | 81 | 68 | -13 |

| North America | 183 | 198 | 15 |

| South America | 33 | 33 | 0 |

| Western Europe | 219 | 220 | 1 |

Shrinking NPLs

On a more positive note, Greece, Italy and Portugal appeared to be reaping the rewards of their efforts to tackle their non-performing loans (NPLs). For the first time in five years, Greek banks achieved growth in pre-tax profits and Italy has the largest increase in pre-tax profits out of western Europe’s countries, while Portugal's pre-tax profits increased by 10.58%.

Allowances for loan losses decreased significantly in all three, by 35.96%, 22.81% and 22.80% in Portugal, Italy and Greece respectively, with impairment charges and provisions reducing by 4.58%, 16.95% and 20.43% respectively.

Although they have made clear improvements, an Italian bank and two Greek banks still make up the three banks with the largest NPL ratios, all above 30%. Trade Bank of Iraq, a state-owned financial institution established in 2003 to support increased import and export activity comes in fourth position with an NPL ratio of 29.93%. Brazil’s Banco BMG, with the fifth highest NPL ratio in the rankings, has struggled with a high NPL ratio for several years, although its current NPL ratio of 28.80%, is an improvement on where it stood in 2018 at 32.90%.

Tax paid as percentage of operating income by bank

| TOP 1000 Rank | Bank | Region | Country | Taxes (USD m) | Tax paid as % of Net operating income |

| 76 | HDFC Bank | Asia-Pacific | India | 1,446 | 15.3 |

| 52 | ANZ Banking Group | Asia-Pacific | Australia | 1,806 | 14.97 |

| 53 | Westpac Banking Corporation | Asia-Pacific | Australia | 1,999 | 14.9 |

| 49 | Commonwealth Bank | Asia-Pacific | Australia | 2,339 | 14.66 |

| 96 | Industrial Bank of Korea | Asia-Pacific | South Korea | 541 | 13.46 |

| 1 | ICBC | Asia-Pacific | China | 11,220 | 13.08 |

| 65 | Shinhan Financial Group | Asia-Pacific | South Korea | 1,096 | 12.63 |

| 66 | DZ Bank | Europe | Germany | 943 | 12.36 |

| 15 | Banco Santander | Europe | Spain | 4,974 | 12.36 |

| 55 | National Australia Bank | Asia-Pacific | Australia | 1,410 | 12.28 |

| 27 | Sberbank | Central and Eastern Europe | Russia | 3,620 | 12.03 |

| 32 | Deutsche Bank | Europe | Germany | 2,955 | 11.72 |

| 17 | China Merchants Bank | Asia-Pacific | China | 3,392 | 11.36 |

| 61 | KB Financial Group | Asia-Pacific | South Korea | 1,054 | 11.3 |

| 33 | BBVA | Europe | Spain | 2,307 | 11.23 |

| 2 | China Construction Bank | Asia-Pacific | China | 8,208 | 11.16 |

| 81 | Hana Financial Group | Asia-Pacific | South Korea | 849 | 11.13 |

| 19 | Norinchukin Bank | Asia-Pacific | Japan | 281 | 11.04 |

| 34 | ING | Europe | Netherlands | 2,122 | 11 |

| 69 | Sumitomo Mitsui Trust Bank | Asia-Pacific | Japan | 696 | 10.94 |

African improvements

It has been a steady year for Africa’s banks at an aggregate level. Three additional African banks are in the Top 1000 this year, with Tunisia’s Banque Nationale Agricole returning to the rankings, after dipping out in 2019 and Egypt’s Faisal Islamic Bank appearing for the first time since 1999. Morocco’s Credit Immobilier et Hotelier has made its Top 1000 debut. This takes the number of African banks in the Top 1000 up to 36, the highest number since 2015, which had an all-time high of 37.

The value of Tier 1 capital and assets at African banks have continued their long-term steady upward trajectory, continuing the recovery from a dip in 2016 and 2017. The value of Tier 1 capital at African banks now stands at $86.16bn, a 14.32% rise year on year and a 26.49% increase since 2015. For assets, this figure now stands at $1068bn, a 10.67% year-on-year increase and a 22.59% increase since 2015. Aggregate pre-tax profits have also continued their pattern of gradual growth since 2017, reaching $23bn, a 12.62% year-on-year increase.

European aggregate profitability

| ROA 2020 | ROA 2019 | ROA % change | ROE 2020 | ROE 2019 | ROE % change | PTP 2020 | PTP 2019 | PTP % change |

| 0.38 | 0.43 | -11.63% | 5.91 | 6.71 | -11.92% | 209,419 | 225,690 | -7.21% |

Across all three metrics, these increases can be largely accounted for by moderate uplifts across several countries, rather than a barnstorming performance by any single individual nation. An exception, however, is Egypt. Its Tier 1 capital increased by 34.51% year-on-year, with a 55.85% uplift in pre-tax profits. The Egyptian government unveiled a major economic reform package in 2016 that aimed to stabilise the economy and give it a significant boost by fostering private sector driven growth. These efforts have been paying off, with Egyptian gross domestic product (GDP) increasing by 5.6% in 2019, compared to 4.6% in the previous three years, and the country’s banking sector is a likely beneficiary.

Aggregate Tier 1 capital, assets and pre-tax profits at African banks

| T1 capital 2020 | T1 capital 2019 | T1 capital change | Assets 2020 | Assets 2019 | Assets change | PTP 2020 | PTP 2019 | PTP change |

| $86160m | $75366m | 14.32% | $1068355m | $965382m | 10.67% | 23,017 | 20,438 | 12.62% |

Several of Egypt’s largest banks have significantly increased their lending activity since 2016, and while other factors are likely to be at play, and have also seen significant increases in pre-tax profits. Egypt’s largest bank, National Bank of Egypt, saw its pre-tax profits increase by 67.44% year-on-year and its second largest, Banque Misr, saw a 78.43% increase. In both cases this followed two years of shrinking profits.

South Africa, however, continues to contribute the lion’s share of profits for the region, accounting for more than half of pre-tax profits raised across Africa. Of the country’s three largest banks, FirstRand had the best year, achieving a 12.29% year-on-year increase in pre-tax profits. A good result compared to largest bank, Standard Bank, which only saw a 1.41% increase; however, this is still a decent improvement on the year before when Standard Bank saw pre-tax profits decrease by 12.93%. Absa, which re-established itself as a brand following Barclays sale of its majority stake in the group in 2017, is yet to make a big mark; year-on-year its pre-tax profits increased by 2.89%, its Tier 1 capital has remained about level since 2017 with a 5% increase in assets.

The foreign exchange effect

| Bank | Country | Actual rank | Rank Excluding FX Depreciation |

| Banco Macro | Argentina | 685 | 505 |

| Banco de Galicia | Argentina | 652 | 477 |

| Banco Provincia | Argentina | 958 | 795 |

| Banco de la Nacion Argentina | Argentina | 584 | 430 |

| Banco Angolano de Investimentos | Angola | 913 | 761 |

| Banco BIC | Angola | 915 | 763 |

| Banco de Fomento Angola (BFA) | Angola | 861 | 715 |

| Banco Hipotecario del Uruguay (BHU) | Uruguay | 808 | 749 |

| National Bank of Uzbekistan (NBU) | Uzbekistan | 699 | 642 |

| Banco de la Republica | Uruguay | 526 | 472 |

| United Bank | Pakistan | 799 | 752 |

| MCB Bank | Pakistan | 805 | 762 |

| Allied Bank | Pakistan | 971 | 928 |

| Habib Bank | Pakistan | 741 | 704 |

| Bank Pasargad | Iran | 591 | 555 |

| RBL Bank | India | 606 | 571 |

| National Bank of Pakistan | Pakistan | 765 | 730 |

| Anadolubank | Turkey | 998 | 966 |

| Federal Bank | India | 502 | 471 |

| Bank Alfalah | Pakistan | 997 | 967 |

| Macquarie Group | Australia | 173 | 144 |

| State Bank of Mauritius | Mauritius | 963 | 934 |

| IDFC FIRST Bank | India | 481 | 453 |

| ME Bank | Australia | 792 | 764 |

| Banco Security | Chile | 817 | 789 |

| Yes Bank | India | 473 | 448 |

| Suncorp Metway | Australia | 418 | 395 |

| Banco del Estado de Chile | Chile | 431 | 408 |

| Banco BICE | Chile | 824 | 801 |

| Banco Consorcio | Chile | 871 | 849 |

| Newcastle Permanent Building Society | Australia | 910 | 888 |

| MCB Group | Mauritius | 582 | 561 |

| Bank of Queensland | Australia | 452 | 432 |

| Akbank | Turkey | 172 | 154 |

| TBC Bank | Georgia | 827 | 809 |

| Bank of Georgia | Georgia | 888 | 870 |

| Turkiye Is Bankasi | Turkey | 156 | 139 |

| Banco Falabella | Chile | 834 | 817 |

| VakifBank | Turkey | 201 | 185 |

| Banco BHD Leon | Dominican Republic | 863 | 847 |

| Banco Popular Dominicano | Dominican Republic | 742 | 727 |

| Bendigo and Adelaide Bank | Australia | 371 | 357 |

| Yapi Kredi Bankasi | Turkey | 193 | 180 |

| Banco de Chile | Chile | 274 | 261 |

| Turkiye Halk Bankasi | Turkey | 216 | 204 |

| IndusInd Bank | India | 261 | 249 |

| Banco de Reservas | Dominican Republic | 843 | 831 |

| TC Ziraat Bankasi | Turkey | 114 | 104 |

| Axis Bank | India | 131 | 121 |

| Banco de Credito e Inversiones (BCI) | Chile | 258 | 248 |

| HDFC Bank | India | 76 | 68 |

| Kotak Mahindra Bank | India | 182 | 175 |

| Commonwealth Bank | Australia | 49 | 46 |

| ANZ Banking Group | Australia | 52 | 49 |

| Westpac Banking Corporation | Australia | 53 | 50 |

| ICICI Bank | India | 101 | 98 |

| National Australia Bank | Australia | 55 | 53 |

| State Bank of India | India | 57 | 55 |

Latin American moves

While Brazil continues to assert its economic dominance in Latin America, other countries are increasingly making an impact. Its banks still account for 54.88% of the region’s pre-tax profits, but this is a significant decrease from 82.75% a decade ago. Chile, Colombia and, in particular, Mexico have seen their share of regional profits increase in the last decade to 7.03%, 8.54% and 10.45%, respectively: almost doubling that of Chile’s share in 2010, more than double for Colombia and more than triple for Mexico.

The increase may be accounted for in the expansion of business lending undertaken by banks in these three nations. As an aggregate share of its gross loan book, just 34.43% of Brazilian bank loans are to corporate borrowers, a much bigger proportion go to retail customers. Whereas the inverse is true for Mexico, Chile and Colombia, where corporate borrowers account for 50.72%, 50.92% and 55.04% of the loan book, respectively.

Overall, 2019 was a difficult year for Latin America’s largest economy, which struggled with anaemic growth, as well as for its banks. Despite an impressive aggregate ROE of 18.83%, this did not translate into impressive profits for the Brazil’s banks, where aggregate pre-tax profits were down 4.58%. 2020 looks very unlikely to mark a turn in fortunes. At the time of writing, Brazil was the second-hardest hit country in the world from the Covid-19 pandemic, in terms of recorded cases and deaths. The handling of the pandemic has only sought to increase the level of conflict between Jair Bolsonaro’s government and state institutions, as well as state governors, making sure-footed progress on measures to improve the economy unlikely.

Mergers and acquisitions in Top 1000

| Bank | Country | Tier 1 for previous ranking ($m) | Buyer (country) | Note |

| Dexia Kommunal Credit | Germany | 640 | Helaba Bank (Germany) | Tier 1 capital end 2018 |

| Bank Danamon Indonesia | Indonesia | 2,430 | Mitsubishi UFJ Financial Group (Japan) | Tier 1 capital end 2018 |

| Unipol Banca | Italy | 603 | BPER Banca (Italy) | Tier 1 capital end 2018 |

| Alawwal Bank | Saudi Arabia | 3,879 | Merged into Saudi British Bank | |

| Thanachart Bank | Thailand | 3,220 | TMB Bank (Thailand) | Tier 1 capital end 2018 |

| Denizbank | Turkey | 2985 | Emirates NBD (UAE) | Tier 1 capital end 2018 |

| Charter Savings Bank | UK | 536 | One Saving Bank (UK) | Tier 1 capital end 2018 |

| Union National Bank | United Arab Emirates | 4,980 | Merged into ADCB to create Abu Dhabi Commercial Bank Group | |

| Al Hilal Bank | United Arab Emirates | 1,522 | Merged into ADCB to create Abu Dhabi Commercial Bank Group | |

| SunTrust Banks | US | 19,306 | SunTrust Banks and BB&T merged to create Truist Bank | |

| TCF Financial Corp | US | 2,408 | Merged into Chemical Financial Corporation | |

| MB Financial | US | 1,959 | Fifth Third Bancorp (US) | Tier 1 capital end 2018 |

| FCB Financial Holdings | US | 1,294 | Synovus Financial Corp (US) | Tier 1 capital end 2018 |

| LegacyTexas Group | US | 935 | Merged into Prosperity Bank | |

| Beneficial Bancorp | US | 916 | WSFS Financial Corporation (US) | Tier 1 capital end 2018 |

| United Financial Bancorp | US | 610 | People's United Financial (US) | Tier 1 capital end 2018 |

| State Bank Financial Corporation | US | 588 | Merged into Cadence Bank | |

| Oritani Financial Bancorp | US | 520 | Merged into Valley National Bancorp |

M&A shake-up

There has long been speculation, since the financial crisis, about whether there would be a wave of consolidation activity in the US’s relatively fragmented banking market. The biggest banking merger and acquisition (M&A) transaction in 2019 – the merger between US banks, BB&T and SunTrust (previously 81 and 87 in the Top 1000 rankings) to form Truist Bank – has breathed new life into these discussions.

The merger, which was announced in 2018, created the 48th largest bank by Tier 1 capital in the Top 1000 ranking, with $40.7bn in Tier 1 capital to its name, and the ninth largest bank in the US. Some analysts believe the “merger of equals” between the two banks could provide a blueprint for other large regional banks in the US to follow, in order to create meaningful challengers to the US’s big four megabanks.

Although the SunTrust and BB&T merger was by far the largest in 2019, there were eight other M&A transactions between US banks including between Michigan-based Chemical Finance Corp and Minnesota’s TCF Financial Corp, as well as the acquisition of Illinois-based MB Financial by Ohio’s Fifth Third Bancorp.

Europe’s fragmented banking system has also long been the subject of speculation about potential consolidation, however, other than a few relatively small transactions in Italy, Germany and the UK, it was another year of inactivity. The acquisition of Turkey’s Denizbank by UAE-based Emirates NBD provided one instance of a reasonably large European transaction. Between 2012 and 2019, Denizbank was owned by Russia’s Sberbank and was its largest overseas asset. The sale, worth $2.7bn at the time of completion, was part of Sberbank’s shift back to focusing on its home market.

The second and third largest bank M&A transactions of the year came courtesy of the Middle East, continuing a wave of consolidation in the region in recent years. Between 2016 and 2020, this consolidation has resulted in the number of banks decreasing from 96 to 78 (this total includes the 68 Middle East banks listed in this year’s Top 1000 plus 10 Lebanese banks that we were unable to gather data from this year).

In the UAE, Union National Bank was merged into Abu Dhabi Commercial Bank Group (ADCB), along with smaller bank Al Hilal Bank, consolidating ACDB’s position as the country’s third largest lender, following a regional trend for the creation of megabanks. All three banks have a common shareholder in the Abu Dhabi Investment Council.

Saudi Arabia has also been drawn into the action, with Alawwal Bank merging with Saudi British Bank, which is 40% owned by HSBC and 60% by Saudi shareholders. It was the first banking sector merger within Saudi Arabia in 20 years and took about two years to complete, reflecting the relatively untested regulatory environment for bank mergers in the country.

Significant though this deal was, throughout 2019 it threatened to be overshadowed by a merger between National Commercial Bank, Saudi’s largest bank, and Riyad Bank, its fourth largest bank at the time the merger was announced in December 2018. However, a year later in December 2019, both banks announced without explanation the merger talks had ceased.

This deal’s collapse raises questions of whether the run of consolidation within the Middle East, which has been under way for several years, is running out of steam. The motives for further consolidation certainly remain compelling. The Middle East is still overbanked; cost pressures continue to bite in a climate of low oil prices, driving a desire for increased efficiencies; and there remains considerable ambition among the leading banks to take on bigger market share in the region and to make an impact internationally – and to do that, they need scale. However, many of the bigger deals that have completed successfully have involved two banks with common shareholders, making for a smoother process. Future deals without the benefit of existing relationships and a clear overlap in interests may be more difficult to achieve.

Latin America loan book composition (%)

| Financial institutions | Corporate | Government | Retail | |

| Brazil | 8.59 | 34.43 | 4.52 | 52.45 |

| Chile | 4.07 | 50.92 | 4.07 | 40.92 |

| Colombia | 0 | 55.04 | 3.54 | 41.41 |

| Mexico | 2.27 | 50.72 | 14.75 | 32.25 |

The creation of so-called megabanks in Qatar and the UAE, and the increasing ambition of banks in these two countries, has drastically shifted the banking profits landscape in the region. Although Saudi Arabian banks continue to account for a large chunk of regional profits, representing 28.9% of pre-tax profits in the Middle East, it is no longer the region’s definitive leader. UAE banks now account for 27.25% of the region’s profits, up from 10.86% two decades ago, and Qatar’s share of regional profits have increased from just 2.33% in 2000 to 15.05% in 2020. By contrast, Israel’s banks have seen their share of regional profits fall from 22.56% 20 years ago to 9.89% today.

Top 10 banks with highest non-performing loan ratios

| TOP 1000 Rank | Bank Name | Country | Non-Performing Loans (NPL%) |

| 976 | Illimity Bank | Italy | 33.91 |

| 200 | Piraeus Bank Group | Greece | 33.5 |

| 167 | Alpha Bank | Greece | 30.1 |

| 319 | Trade Bank of Iraq | Iraq | 29.93 |

| 855 | Banco BMG | Brazil | 28.8 |

| 774 | Provident Financial Group | UK | 26.9 |

| 658 | Hellenic Bank | Cyprus | 25.8 |

| 432 | Bank of Cyprus | Cyprus | 24.6 |

| 191 | Eurobank Ergasias | Greece | 23.7 |

| 851 | First Investment Bank | Bulgaria | 23.4 |

| 213 | National Bank of Greece | Greece | 20.08 |

A taxing business

The amount of tax being paid by banks is an ongoing issue of considerable global interest, and our analysis suggests Australian banks pay the highest proportion as a percentage of net operating income, at 13.28% on average. Although Indian bank HDFC tops the table of individual banks paying a high proportion of tax, three Australian banks hold the second, third and fourth positions, with Asia-Pacific the leading region. It is perhaps relatively unsurprising that Australian banks are at the top of the table, given that since 2017 the country’s largest banks have faced an additional levy, which is paid on balance sheet liabilities. Of the 20 banks which pay the most tax, all are within Asia-Pacific or Europe.