Nigerian banks have had a solid, if unspectacular, year since the publication of The Banker's Top 1000 global bank rankings in 2008. Collapsing commodity prices and the drying up of external financing, due to the global economic recession, have taken their toll on the sector. Despite this, the Nigerian banking sector as a whole boosted its total pre-tax profits substantially in the calendar year 2008 to $3bn, from $1.9bn in calendar year 2007.

In terms of individual banks' pre-tax profit, Zenith Bank led the field in the 2009 rankings. It increased its profits by 136% and shot to the top of the league in terms of pre-tax profit for 2008. United Bank for Africa also had a strong year in terms of pre-tax profit, which grew just over 100% from $202m in last year's rankings to $407m this year.

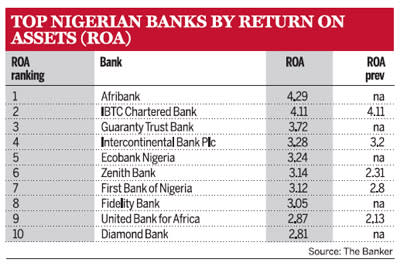

Once again, Nigeria's banks' assets show significant growth between the publication of this year's and last year's rankings. More importantly, however, the return on assets also grew. The average return on assets for those Nigerian banks that made it into the Top 1000 rankings in 2009 was 3.02%, compared with an average return on assets of 2.72% in last year's rankings. The highest return on assets across the sector was achieved by Afribank, which was also a new entry in 2009. Its return on assets was an impressive 4.29%.

Nigeria's banks also continued to amass Tier 1 capital in 2008, making them even stronger than last year when compared to the traditionally dominant South African banks. Whereas last year Nigeria's banks made up 34% of total Tier 1 capital from the sub-Saharan banks, this year they made up 43.4%. South Africa's share of total Tier 1 capital fell from 62% in last year's rankings to 52.8%.

However, a dark cloud looms over the sector. The Nigerian banks have been hit hard in 2009 by the financial crisis as oil revenues plummet in the country and access to external financing dries up. A collapse in the Nigerian Stock Exchange in late 2008, which wiped 60% of the value of stocks, left banks reeling and exposed many of them to staggering losses from their margin trading activities. Next year's rankings will undoubtedly reveal a somewhat more sober set of results.

It was also noticeable that Nigeria's upward surge in the Top 1000 rankings has been somewhat staunched. Whereas last year the country had four banks in the top movers category, two of which took the first and second places, this year just two Nigerian banks made it into the highest movers category.

Top Nigerian Banks by Assets

Top Nigerian Banks by Profits

Top Nigerian Banks by Return on Assets (ROA)