Central bank digital currencies (CBDCs) are moving beyond the test phase for several Asian countries, leading to discussion of how the currencies will operate and how the region’s central banks will need to collaborate.

Agreements made in 2019 under the Association of Southeast Asian Nations Payment Connectivity initiative called for closer ties between member nations to promote payment system interoperability. While this has pushed forward the use of QR codes and real-time payments across borders, it has been of particular benefit to the development of CBDCs.

Collaboration has helped to accelerate progress on CBDCs, which have the potential to provide a wide range of benefits, from reducing the cost of remittances to bridging gaps in the correspondent banking network. The greater levels of transparency offered by the transactions would aid anti-money laundering and know-your-customer checks.

There is still a lot of work to be done before CBDCs are fully operational, and they will require even greater levels of collaboration. While digital currencies can provide better traceability, there is still a need for customer privacy. It is a delicate balance which needs to be ironed out to gain customer confidence, while keeping them protected.

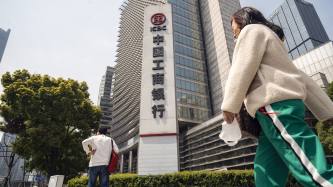

Another major consideration is how the currencies will be stored and transacted. Will central banks choose to run their currencies on the blockchain, or follow China’s lead and decide not to use this emerging technology? Currencies on the blockchain have the benefit of being programmable – meaning business rules can be embedded in them, such as moving to a jurisdiction with greater liquidity. However, whether these rules are to be developed by the private sector or the central banks themselves is another decision to be made.

Finding the solutions to these issues will not be a quick process and will rely on the continued good relations between countries across Asia. But the level of collaboration seen in the region could provide an example for other regions to follow.