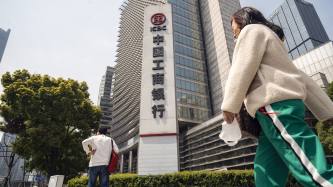

The China growth story has been underpinned by the meteoric rise of its banks, with its lenders now occupying the top four spots in The Banker’s annual Top 1000 World Banks ranking.

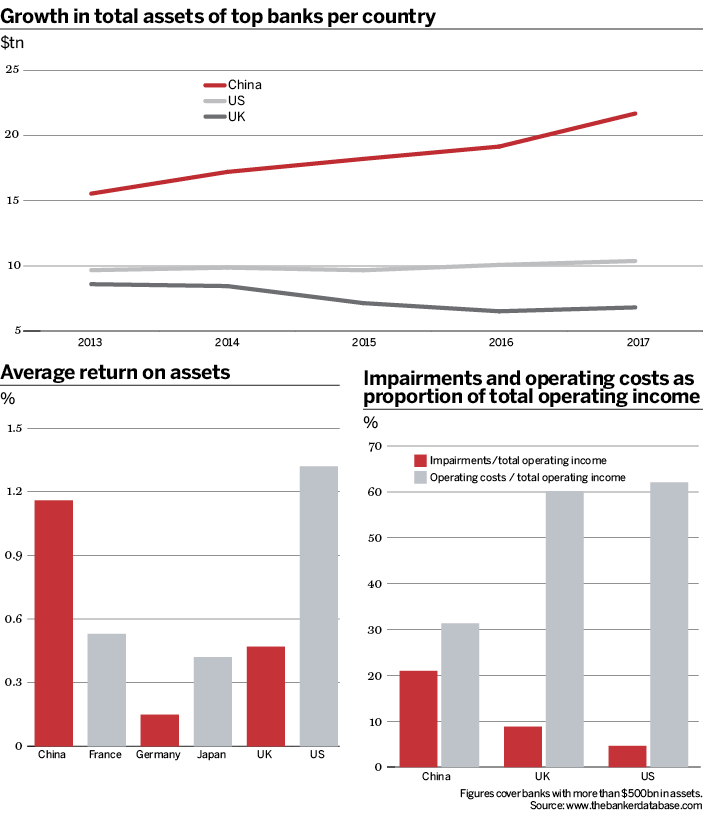

In the past five years, the 12 Chinese mega-banks – those with more than $500bn in assets as of the end of 2017 – have boosted their aggregate balance sheet by almost 40%. In comparison, the six US mega-banks have added just 7% over the same timescale, while the five UK mega-lenders’ aggregate balance sheet has contracted by 21%.

Lower costs

At the same time, the running costs for Chinese mega-banks are about half that of other countries’ top lenders. For example, the ratio between operating costs and total operating income for Chinese mega-banks is 31%, whereas it is more than 60% for top French, UK and US banks. Germany’s mega-lenders have a cost-to-income ratio of almost 85%.

The low ratio is mainly due to low staffing costs in China. For every dollar spent on staff costs, Chinese mega-banks see an average pre-tax profit of $2.61, whereas US banks achieve about $0.92 and top French and UK banks average about $0.69 and $0.63, respectively.

It is generally accepted that the lower the cost-to-income ratio, the more profitable a bank will be – so, based on these encouraging metrics, one would expect Chinese mega-lenders to be much more profitable than they are.

But while above the global average of 0.9%, the return on assets percentage of Chinese banks (1.16%) is less than that of US banks (1.32%). Hence, despite a massive growth in assets, Chinese banks are deriving less revenue from these assets.

Profitability conundrum

What is at the heart of this low profitability in the Chinese banking sector? Fundamentally, it is the quality of assets on Chinese banks’ loan books, as well as the management of those assets.

On average, Chinese mega-banks’ average impairments as a percentage of total operating income are almost four times that of their US and German counterparts. The top six Chinese banks report $76.8bn in impairment charges and provisions, whereas the top six US lenders report just $19.4bn.

And, despite the large number of impairments reported on the Chinese balance sheets, many believe that many non-performing loans (NPLs) are still not being fully recognised.

Besides lower impairments, US mega-banks are much better at utilising their assets compared with their Chinese counterparts. For example, Wells Fargo, Morgan Stanley and Citi have asset utilisation ratios north of 4%. In comparison, the top six Chinese banks average 2.57%, with the highest rate of 2.76% attributed to China Construction Bank.

Quality counts

Loan quality and management is of greater importance to Chinese mega-banks since loans make up a larger proportion of their assets: 55% of top Chinese lenders’ assets, compared with 37% for the US banks, for example.

In addition, the aggregate loan book for the top Chinese banks is growing at a faster pace than peers elsewhere – four times faster than the US mega-banks and twice as fast as those from the UK.