China's banking dominance has extended into the net interest income rankings, though the trading income tables have a more old-world feel to them.

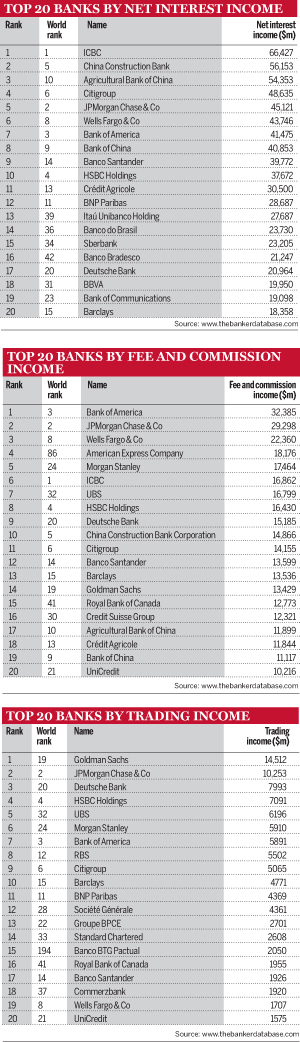

Chinese banks dominate the net interest income rankings in this year’s Top 1000 World Banks. In the 2013 ranking, the top three lenders by this measure (and the only ones to make more than $50bn of net interest income) were from China.

Moreover, in contrast to banks from the US and western Europe, their net interest income is rising. ICBC’s increased 15% over last year’s figure, while China Construction Bank and Agricultural Bank of China’s went up by 16% and 11%, respectively.

The net interest income of Citi, which was higher than that of any non-Chinese bank, dipped 3% from 2012. Bank of America’s fell 11% to $41bn.

Aside from Chinese lenders, Brazilian and Russian banks were among the biggest risers. Brazil’s Itaú Unibanco and Bradesco increased their net interest by 24% and 12%, respectively, while Russia’s Sberbank saw an even more impressive gain of 33%.

US and European banks continue to rule the trading income rankings. Of the top 20, only two banks from outside those regions (Brazil’s BTG Pactual and Royal Bank of Canada) feature. Goldman Sachs came top, making $14.5bn of trading income, up 48% from 2012 and over $4bn more than its nearest rival, JPMorgan. Morgan Stanley, which made more trading income than any other bank in 2012, saw a huge decline of 56% to $5.9bn this year, placing it sixth globally.

US banks make up the top five lenders for fee and commission income in this year’s Top 1000. Bank of America, which made $32bn of such revenues, finished top of this particular ranking.