The RBI’s incoming governor Urjit Patel inherits a well-capitalised sector with a growing NPL problem.

On September 4 Urjit Patel will take over as India’s central bank governor, following Raghuram Rajan’s announcement in June that he was stepping down. Currently deputy governor of the Reserve Bank of India, Mr Patel will inherit a highly capitalised set of lenders with some troubled loan books.

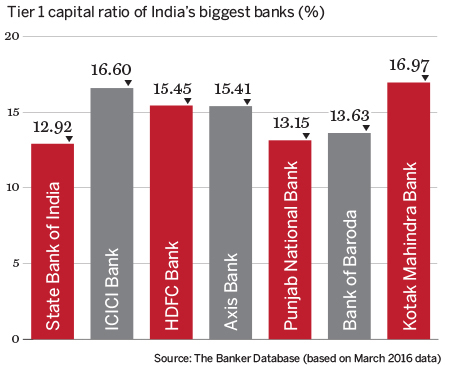

Of the 33 Indian banks for which The Banker has 2016 data, all have tier 1 capital ratios comfortably above the Basel III minimum of 6%. The biggest seven hover between 12.92% and 16.97%.

The sector’s liquidity, however, is less impressive. Based on The Banker’s latest Top 1000 rankings, the global average loan-to-deposit (LTD) ratio is 85.3%. Yet among India’s banks, it’s 95.69%. The country’s top tier lenders are among the worst offenders: ICICI’s latest LTD ratio sits at 117.83% and Kotak Mahindra Bank’s at 109.94%.

However, non-performing loans are a more pressing concern. Of the world’s biggest 1000 banks tracked by The Banker, the average proportion is 3.62% while India’s is nearly double that at 7.65%. Among its biggest lenders, Punjab National Bank faces the biggest challenges with problem loans accounting for 12.9% of its loan book as at March 31, 2016.