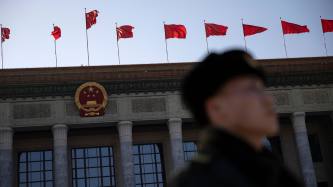

China has set a growth target of around 5 per cent for this year, accompanied by a fiscal deficit of 3 per cent of its gross domestic product. Premier Li Qiang announced these targets during the opening of the annual National People’s Congress on Tuesday, presenting them in his keynote “work report” speech.

Investors are closely monitoring this year’s meetings, known as the “Two Sessions”, involving the NPC, China’s rubber-stamp parliament, and its top advisory body, the Chinese People’s Political Consultative Conference. They are keenly observing for signals on how the ruling Chinese Communist party plans to shore up the country’s slowing economy.

The targets align with last year’s report and analysts’ predictions. However, most analysts caution that achieving the 5 per cent target for 2024 would be more challenging than the 5.2 per cent recorded in 2023, given the country’s economy is starting from a higher base since its ongoing recovery from the Covid-19 pandemic-induced flattening.

China’s $18tn economy faces significant headwinds, including deflationary pressures, a property crisis, a stock market rout and mounting local government debt. Last year, foreign direct investment in China declined by 82 per cent to $33bn, the lowest annual figure since 1993.

Additionally, Li disclosed plans to issue Rmb1tn ($139bn) in ultra-long government bonds for major projects. However, analysts argue that this falls short of the significant stimulus package needed to boost markets and reassure worried investors.

—

Companies House, the UK’s government-owned central corporate register, came under fire yesterday after revelations that hundreds of “erroneous” filings were made last month, pertaining to the discharge of financial liabilities at 190 UK-registered companies.

Some of the UK’s largest banks, including NatWest, Lloyds Banking Group and Barclays, are on alert regarding this issue. The Bank of England is identified as the security trustee on at least one of the affected charges.

As reported by Sky News, a note issued by the banking trade association UK Finance revealed that approximately 800 filings made in February appeared to indicate the release of properties owned by companies from charges granted to banks in exchange for loaned funds. This suggests that in the event of a failure to repay, the lender would lose its entitlement to seize these assets. According to sources, these filings were carried out without the knowledge of the affected companies or lenders.

The Financial Times noted that the “saga raises more questions about the quality of information at Companies House and the ease with which it can be manipulated”. The newspaper also highlighted instances where “Jesus Holy Christ” and “Donald Duck” were previously listed as company directors on the register.

Companies House said on Monday that it was investigating and had launched an “urgent review” of its processes after identifying the filings concerned.

—

US banks opposing stricter capital rules have gained support from the renewable energy industry. The Basel III endgame proposal, being finalised by the Federal Reserve and other US banking regulators, faces criticism from major banks including JPMorgan and Bank of America, who argue that increased capital requirements may raise borrowing costs and shift lending away from regulated banking.

As reported by the Financial Times, the major US banks have been among the biggest sources of renewable finance through a system called tax equity, which enables them to claim credits against tax liabilities by investing in green energy. Renewable energy developers have expressed concern, claiming the proposed Basel III endgame rules could jeopardise the tax equity system, a vital source of their funding. Industry groups warn that the clean-energy transition might be derailed, with estimates suggesting an 80 to 90 per cent reduction in the tax equity market.

Federal regulators have signalled their openness to adjusting risk weighting on renewable projects, but uncertainty persists. Long-standing tax credits for US wind and solar power projects were extended under the Inflation Reduction Act, a significant climate law passed in 2022. However, developers often lack the tax liability to use these credits, leading them to engage in transactions with banks.

—

New Zealand’s central bank has announced a new requirement for banks to report major cyber security incidents within 72 hours, as part of its plans to implement formal cyber reporting requirements in phases throughout this year.

Under the proposed rules, banks must additionally inform the Reserve Bank of New Zealand of all cyber incidents, with large entities required to report such incidents every six months and other entities annually. They must also disclose any self-assessment measures.

The country has seen a rise in cyber attacks in recent years, prompting the government in 2023 to boost its cyber defence by setting up a lead agency to make it easier for the public and businesses to seek help in the event of a breach. The RBNZ itself suffered a cyber attack in 2021, which breached its data systems and compromised a file-sharing service used by the central bank to share information with external stakeholders.

—

JPMorgan has become the first US bank to join France’s domestic payment network Cartes Bancaires, as it aims to offer cheaper card payments to its merchant clients across the country.

Established in 1984, Cartes Bancaires processes over 15bn transactions annually, accounting for approximately 65 per cent of all consumer transactions in France. Principal members of the network include BNP Paribas, Credit Agricole, Société Générale and HSBC Holdings.

“Joining the Cartes Bancaires network was mainly a demand from our merchant clients, as the use of the network can be cheaper than other card networks,” said Ludovic Houri, JPMorgan’s co-head of payments and commerce solutions for Europe, the Middle East and Africa. “We wanted a seat at the table, like a European bank, and we want to support the Cartes Bancaires network.”