The Banker’s 2019 Top 250 EU Banks ranking provides a snapshot of a sector struggling to find growth in a sluggish operating environment. Over the 2018 review period, the gross domestic product of the EU’s 28 economies expanded by just 1.9%, down from the 2.4% achieved in the previous year, according to data from Eurostat.

In particular, growing global trade tensions and uncertainties over Brexit, among other issues, weighed heavily on the EU’s economic performance in the second half of 2018. These cooler economic conditions hit the performance of banks across the region, contributing to marginal declines across most metrics in the ranking.

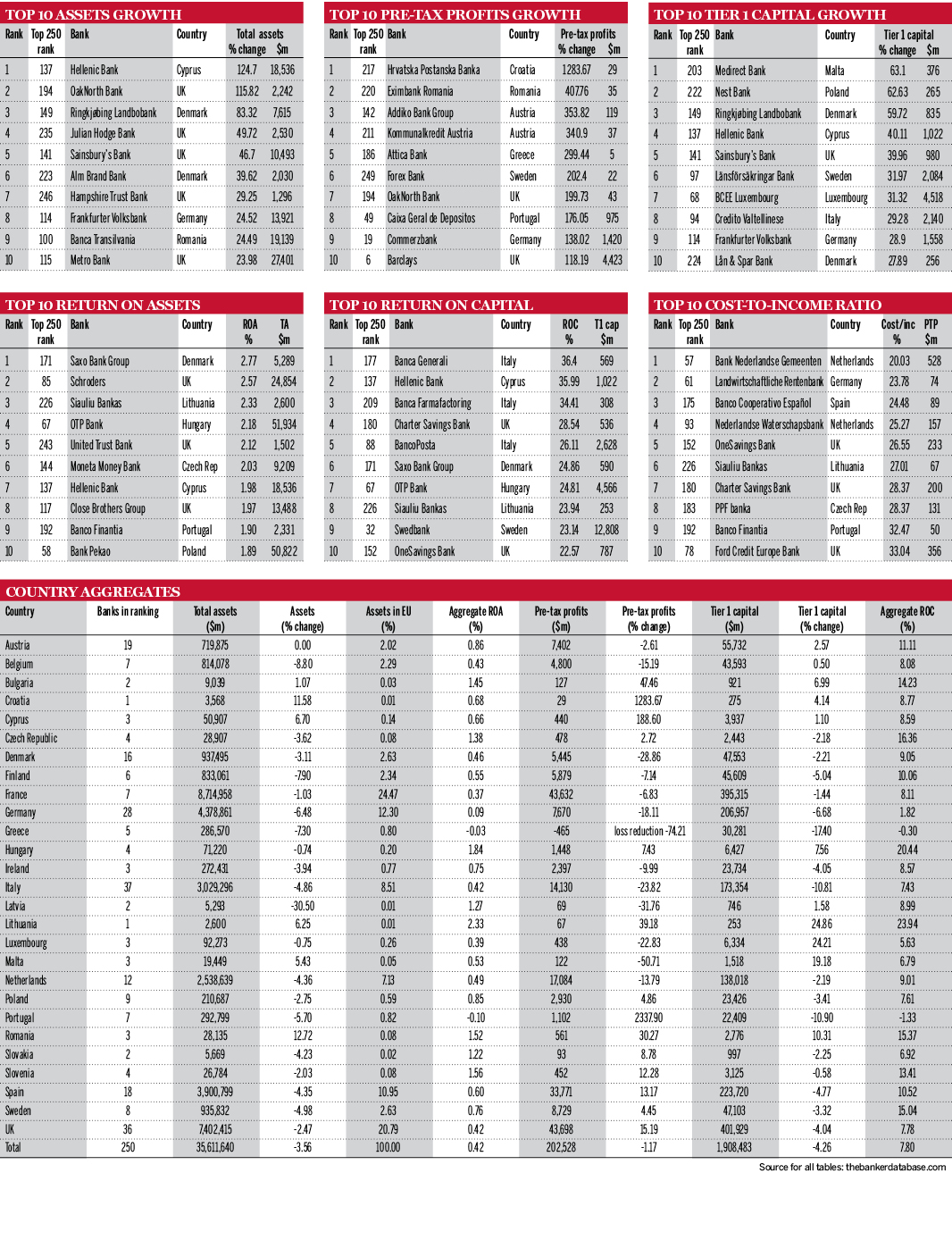

On an aggregate basis, the total assets of the EU’s banks fell by 3.56% to $35.61bn. This was accompanied by a decline in their return on assets, which dropped to 0.42% from 0.55% in the 2018 ranking. In tandem, pre-tax profits registered -1.17%. EU lenders also experienced a modest contraction to their Tier 1 capital positions, with the aggregate figure decreasing by 4.26% in the 2019 ranking, while their return on capital dropped to 7.8% from 10.1%. It should be noted, however, that these declines in key performance metrics come off the back of relatively strong figures in the 2018 ranking.

CEE successes

The aggregate numbers also mask a number of notable success stories at the country level, particularly in central and eastern Europe. Romanian lenders, for example, enjoyed asset growth of more than 12% in the 2018 review period, while their aggregate return on assets was well above the regional average at 1.52%. Indeed, the country’s banks saw their pre-tax profits climb by 30%. Elsewhere, Hungarian lenders maintained their steady trajectory by once again posting healthy numbers across their return on assets, pre-tax profits and Tier 1 capital indicators.

A diverse set of lenders feature in the top 10 banks by Tier 1 capital growth in the 2019 ranking. Malta’s Medirect Bank tops the table with a 63.1% increase, while Poland’s Nest Bank is a close second with 62.6%. Two Danish lenders feature in the table with Ringkjøbing Landbobank securing third place, and Lån & Spar Bank rounding out the top 10.

Meanwhile, in terms of asset growth, UK banks feature heavily among the top 10 institutions. A total of five UK lenders feature in the table with OakNorth Bank, which takes second position, the best performer among them with a 115.8% increase in total assets. Julian Hodge Bank, Sainsbury’s Bank, Hampshire Trust Bank and Metro Bank are the other UK institutions to feature in the table.

Relatively little movement has occurred among the EU’s 10 biggest banks in the main ranking, although France’s Crédit Agricole has once again secured second place after being unseated by BNP Paribas in the 2018 edition. This follows a 4% drop in BNP Paribas’ Tier 1 capital in the 2019 ranking. Meanwhile, another French lender, Group BPCE, has replaced the UK’s Barclays in fifth spot.