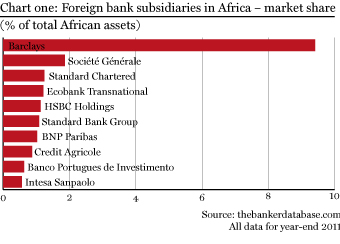

In total, the top 10 cross-border subsidiary networks in Africa account for less than 20% of assets, compared with 26% in Latin America and more than 30% in central and eastern Europe.

Moreover, two of the top 10 networks are owned by African parents: Togo’s Ecobank Transnational and South Africa’s Standard Bank. That leaves just 16.7% of total assets in the hands of non-African parents, all of them European.

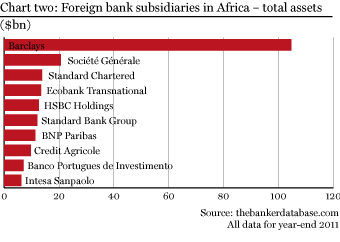

The UK’s Barclays has by far the largest presence, with 9.4% of total African assets. This is almost five times the size of the next largest network, Société Générale. Almost all of Barclays’ assets in Africa – more than 8% of total continental assets – are accounted for by just one subsidiary, Absa Group in South Africa. Absa is 55.5% owned by Barclays, and has total assets of $96.6bn. All but about $1bn of those are in South Africa, with National Bank of Commerce in Tanzania and small operations in Mozambique and Namibia accounting for the rest.

About half of Société Générale’s $20.7bn African assets are those of its Egyptian subsidiary, National Société Générale Bank (NSGB). However, the French bank is currently in the process of selling NSGB to Qatar National Bank. If completed, this deal will introduce the first non-European player to the top 10 foreign banks in Africa, with assets just ahead of France’s Crédit Agricole at number eight.