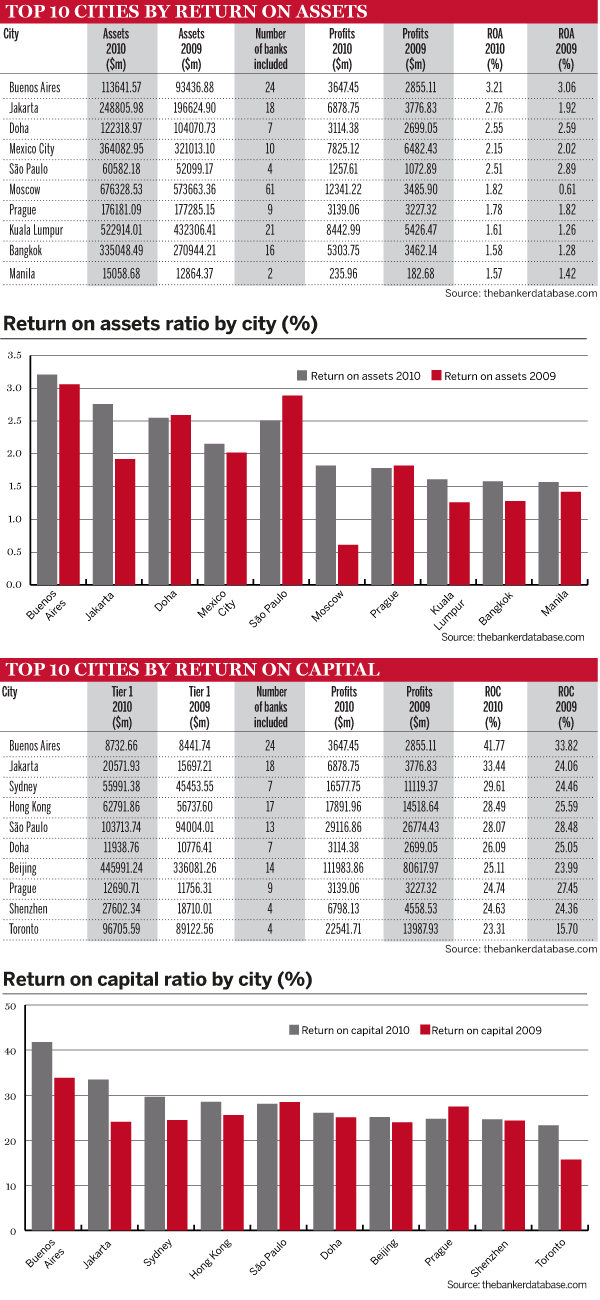

If the size of stock exchanges, the number of financial sector firms, and the volume of international debt securities confirmed New York, London and other major financial centres as the world’s leaders in The Banker’s annual ranking on international jurisdictions (published in October), analysing certain specific banking indicators presents a very different picture.

Looking into return on capital (ROC) and return on assets (ROA) ratios for any kind of investment would favour riskier, faster-growing economies. Yet, while many of the markets displayed in our tables are still developing, they have grown into large and more stable economies – while the assumption that an investment in a US or western European bank is safe has been challenged over the past few years.

Perhaps unsurprisingly, no leading US or European international finance centres are to be found in the best scoring jurisdictions by ROC and ROA.

Argentina’s record year

It should also not be a surprise that, given the record year that Argentine banks had in 2010, Buenos Aires tops both ROC and ROA rankings, showing an interesting growth from the previous year, in particular for its aggregate return on capital ratio, which jumped to a staggering 41.77% in 2010 from 33.82% in 2009 – well ahead of its peers in Latin America’s major economy, Brazil, where São Paulo-based banks showed a 28.07% ROC last year.

In second place in both tables is Jakarta, which has seen both ratios significantly grow. Banks in the Indonesian capital city display an aggregate ROA of 2.76%, up from 1.92% the previous year, while their ROC ratio rose to 33.44% from 24.06% in 2009. These figures signpost the growing success of Indonesian lenders, and the country’s expanding economic clout should encourage its banks to grow their ambitions further.

Also supported by a fast-growing economy, Qatar’s Doha scores well in both tables and is the third highest jurisdiction by banks’ return on assets. The only representative of the industrialised world in the rankings is Toronto in Canada, where prudent management allowed banks to sail through the financial crisis in relatively good shape. The Canadian city appears in 10th position in the ROC ranking with a more than healthy 23.31%, significantly higher than the 15.7% its banks showed in 2009.