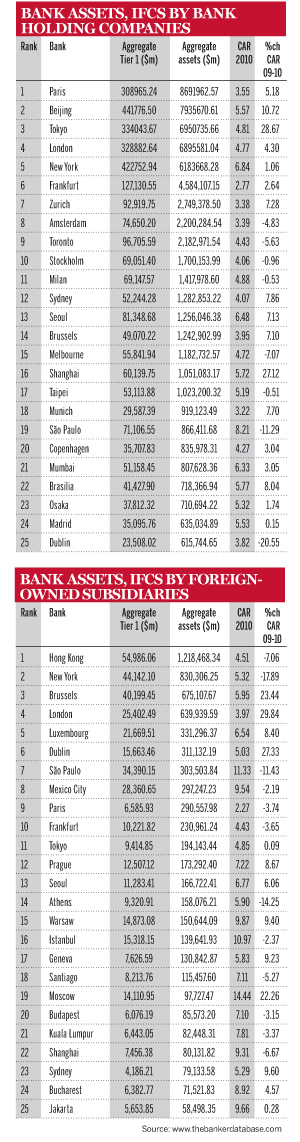

Paris tops The Banker’s Top 25 assets table for bank holding companies, while Hong Kong takes the number one spot in its foreign-owned subsidiaries counterpart.

Out of the top 25 international financial centres with the largest aggregate volume of bank assets, a mix of European, Asian and North American centres occupy the top places in both the ranking that considers bank holdings incorporated in a certain jurisdiction, and the one of foreign-owned subsidiaries operating in the centre.

Tables are kept separate to avoid overestimations, as an international bank that is incorporated, say, in Madrid, but that operates also in Buenos Aires and London, would have all group assets accounted for at the holding level. It would be too approximate to subtract the subsidiaries’ assets from each holding to estimate the value of, in this example, the Madrid-based operations.

The fact that the world’s largest banking centres represent various geographical regions is indicative of the emergence of financial centres other than London and New York.

Paris is comfortably at the top of the bank holdings table, with Beijing and Tokyo in second and third place. London and New York sit in fourth and fifth positions in the table, while the North American centre scores a more flattering second place in the second ranking, by foreign-owned subsidiaries, which is topped by Hong Kong.

Looking at aggregate Tier 1 capital values, Asian centres also score well, with Beijing and Hong Kong displaying the highest Tier 1 capital figures in the bank holdings table and subsidiaries table, respectively.

São Paulo has the lowest level of leverage (or highest capital adequacy ratio – CAR) if bank holdings are considered. The Brazilian centre follows Moscow’s aggregate CAR in the foreign-owned subsidiaries, the highest ratio in that table.

At the other end of the spectrum, Frankfurt and Munich show the highest levels of leverage (or lower CARs) if bank holdings are considered, while Paris and London have the highest ratios if foreign-owned subsidiaries only are considered. Dublin is the smallest by aggregate bank holdings assets and displays one of the highest levels of leverage.