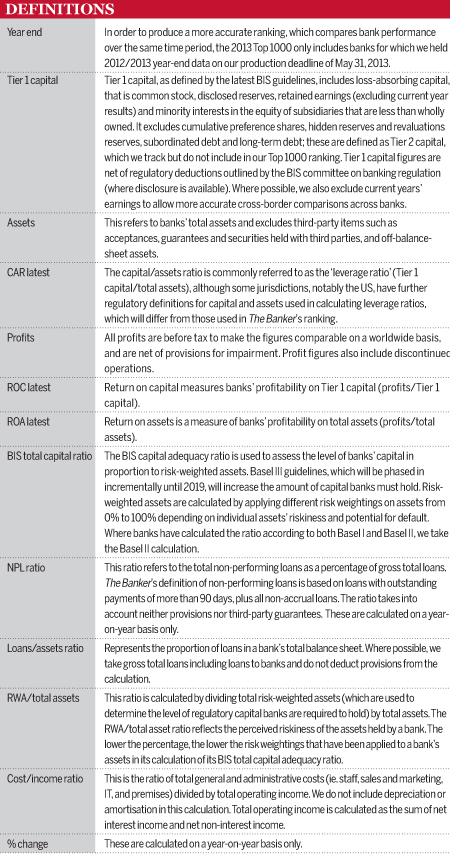

The Banker’s Top 1000 World Banks ranking tracks the largest bank holding companies based on Tier 1 capital. We have analysed close to 2000 financial results in order to produce the Top 1000 2013. We include banks for which we hold audited year-end financial results. We only include banks for which we hold latest results (end of 2012), and aim to track banks at their highest capital regulated consolidation level.

We do not track foreign-owned banks in the main ranking. Foreign-owned subsidiaries are included in the country breakdown, if their Tier 1 would be large enough for them to feature in the Top 1000. Foreign-owned banks are marked ‘FOS’ in the country ranking.

This year’s minimum Tier 1 capital for inclusion was $342m (in comparison with the $284m last year, a 20% increase). The country breakdown starts on page 214 and covers 1293 banks, in 93 countries.

The rankings are based on the definition of Tier 1 capital, as set out by Basel’s Bank for international Settlements (BIS). We always collect Tier 1 capital after regulatory deductions. Where no capital disclosures are available, we recalculate banks’ Tier 1 capital, based on their ‘change in shareholder equity’. Goodwill is deducted from Tier 1 capital, and we exclude current year’s earnings, even where national regulatory authorities allow its inclusion. (Only allocated retained earnings from previous years are included.) All BIS ratios are, however, collected as published. If banks published financials both in statutory and pro-forma figures, we track the statutory figures. Where accounts are available according to both international financial reporting standards and national accounting standards, we have consistently used International Financial Reporting Standards accounts.

Notes

We have used different capital disclosures from the Sudeban (Venezuelan regulator) for Venezuelan banks this year, so the year-on-year percentage changes are not valid.

Canada changed its accounting standards from the Canadian Generally Accepted Accounting Principles to International Financial Reporting Standards this year, so the year-on-year percentage changes are not valid.

The data for Greek banks is collected on a pro-forma basis, in order for their Tier 1 to include agreed re-capitalisations with the Hellenic Financial Stability Fund.